Retiree Healthcare Costs On The Rise

- Bjork Group

Healthcare in retirement is a big ticket item that needs to be factored into your plan for retirement. A recent Fidelity Viewpoints (09/06/2017) research project showed a surge in projected health care out of pocket spending in retirement to $275,000 for a married couple!

Fidelity Benefits Consulting recently updated their estimated health care spending in retirement to $275,000 (up from $260,00 in 2016). What does that mean to you? Three recomendations from the research to keep in mind:

1. Factor Health Care Cost Into Retirement Savings Plan

2. Plan for Long Term Care

3. Be Thoughtful About When you Retire

CONCLUSION:

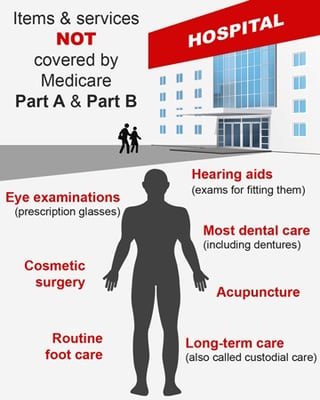

Don't let the cost of health care in retirement be a surprise. Plan ahead, research long term care, Medicare eligability and what is and is not covered to help plan for out of pocket expenses.

Make a plan, educate yourself and your spouse and work toward making smart decisions and being prepared for what comes next!

Image Source: www.Medicare.gov What's not covered by Part A & Part B?

Source: Fidelity.com (https://www.fidelity.com/viewpoints/retirement/retiree-health-costs-rise)